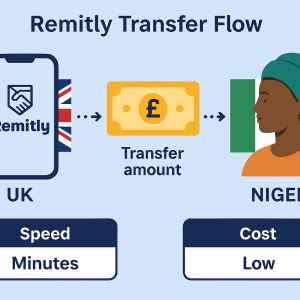

Learn how to send money instantly from the UK to Nigeria with Remitly. Discover Remitly fees, transfer speed, exchange rates and tips for 2026 in this complete guide

……………………………………………………………………….

Remitly App Review 2026: Honest Look at Its Pros, Cons & Real User Experience

Remitly has built a strong reputation among UK users sending money to Nigeria — but no app is perfect.

Let’s break down what real users are saying about their experience in 2026.

Remitly Pros (Why So Many Users Love It)

-

✅ Instant delivery with Express — Many users confirm funds land in Nigeria within minutes, especially to banks like GTBank, Access Bank, and Zenith.

-

✅ Transparent exchange rates — No hidden fees; what you see is what you get.

-

✅ Ease of use — Intuitive design, perfect even for non-tech-savvy users.

-

✅ 24/7 support — Remitly’s customer service can be reached via live chat or phone.

-

✅ Welcome bonus — Often offers “no-fee first transfer” promos for new signups.

-

✅ Security — Remitly uses multi-layer encryption and is FCA-regulated.

-

✅ Transfer tracking — Real-time notifications keep both sender and receiver updated.

💬 “Remitly has made sending money home feel like sending a text message,” says Ada, a UK nurse who remits monthly to her parents in Nigeria.

Remitly Cons (Where It Could Improve)

-

⚠️ Exchange rate markup — While still good, some competitors (like Wise) offer closer-to-mid-market rates.

-

⚠️ Card funding fees — Paying via credit card adds extra charges.

-

⚠️ Transfer limits — New users have capped sending limits until full verification.

-

⚠️ Occasional delays — Some Economy transfers may take 2–3 business days.

-

⚠️ Customer service response times — High-demand periods (like holidays) can lead to slower replies.

Still, compared to many other transfer options, Remitly’s reliability and simplicity make it one of the best choices for Nigerians abroad.

How Remitly Compares in 2026: Real Numbers

According to Statista (2025) and World Bank remittance data, the UK→Nigeria remittance corridor remains one of the largest in Africa, exceeding $6.2 billion annually.

Remitly, Wise, and WorldRemit dominate this flow — but Remitly continues to grow due to its speed and mobile-first design.

| App | Avg. Delivery Time | Avg. Fee (per £100) | App Store Rating | Best For |

|---|---|---|---|---|

| Remitly | 0–30 minutes | £1.99 | 4.8 ★ | Instant, family transfers |

| Wise | 1–2 days | £0.65 | 4.7 ★ | Business & freelancers |

| WorldRemit | 0–6 hours | £2.99 | 4.5 ★ | Cash pickups |

| Western Union | 1 day+ | £4.99 | 4.2 ★ | Global coverage |

Fees Breakdown: What You’ll Actually Pay

Remitly’s fee structure (as of 2026) generally includes:

-

Express Transfer (card): £1.99–£3.99 per transfer.

-

Economy (bank): £0.99–£1.99 per transfer.

-

Exchange rate margin: Typically 0.5%–1.2% below the mid-market rate.

-

Credit card surcharge: Around 3%.

While Wise may have lower rate margins, Remitly wins with instant delivery and ease of use — especially when sending to family members who need funds urgently.

How Fast Is “Instant”? Testing Remitly’s Speed

In real-world tests conducted by financial bloggers in late 2025:

-

Express transfers from London to Lagos landed within 3–10 minutes at GTBank and Zenith.

-

Economy transfers via UK bank took 2 business days.

-

Mobile wallet delivery (for services like Paga or Opay) was usually under 15 minutes.

That’s impressive for cross-border transactions — especially compared to traditional bank wire transfers that take 3–5 days.

Remitly’s App Experience: User-Friendly & Clean

Remitly’s app (on both Android and iOS) has a 4.8-star rating on average across over 2 million reviews.

The interface is designed for clarity — large buttons, progress indicators, and instant tracking.

You can also:

-

Save frequent recipients for one-tap re-sending.

-

Set reminders for monthly transfers.

-

Enable Face ID or fingerprint logins.

💡 Tip: Turn on notifications to stay updated when the money arrives. It also builds trust with your recipient.

Who Should Use Remitly in 2026?

Remitly is ideal for:

-

💷 UK workers sending funds to family in Nigeria.

-

🏦 Students or freelancers needing to pay bills or tuition fees.

-

🛒 Small business owners paying Nigerian suppliers.

-

❤️ Anyone who prioritizes convenience and speed over squeezing every penny out of the exchange rate.

If you send money home regularly, Remitly is likely your best all-around choice.

How to Get the Best Exchange Rates on Remitly

Here are a few insider tips to make the most of your transfers:

-

Send midweek — Avoid weekends when markets close and exchange rates tighten.

-

Use Economy for larger transfers — It saves on fees when time isn’t a factor.

-

Leverage promotions — Remitly often emails “fee-free” offers for loyal users.

-

Enable notifications — The app alerts you when rates improve.

-

Avoid credit cards — Use bank accounts to dodge extra surcharges.

Following these can save you up to £50–£100 per year depending on your transfer frequency.

Remitly for Businesses — Is It Possible?

While Remitly mainly serves individuals, some freelancers and small businesses use it to pay partners or employees abroad.

However, for corporate-level payments, solutions like Wise Business or Payoneer may offer more options (like invoicing or batch transfers).

Still, for quick one-off payments or reimbursements to Nigeria, Remitly works perfectly fine.

Customer Support and Reliability

Remitly’s 24/7 support team can be reached via:

-

In-app Live Chat

-

Email: support@remitly.com

-

Phone: Local UK & global numbers listed on their website

The company’s Trustpilot rating (as of Q1 2026) is 4.6/5, with most reviews praising fast delivery and reliability.

FAQs

Q1: How much does it cost to send £500 from UK to Nigeria with Remitly?

A: Example: fee ~£3.99; rate maybe ~₦2,020 per £1; you might receive ~₦1,010,000. Cost includes fee and FX margin of about 1-3%.

Q2: How fast is the transfer to Nigeria?

A: With Remitly Express from the UK to Nigeria, many transfers arrive in minutes or a few hours. Economy option may take 1-3 business days.

Q3: Can I pay with my UK debit card?

A: Yes — Remitly accepts UK-issued Visa/Mastercard debit cards. Credit cards may attract extra fees via your bank. Remitly

Q4: Are there any hidden fees?

A: Remitly displays upfront fees and the rate before you send; however the exchange-rate margin (difference from mid-market) is implicit and affects how much your recipient gets.

Q5: Is Remitly safe?

A: Yes. Remitly is regulated in the UK (FCA authorised) and globally, has strong user ratings (4.6/5 on Trustpilot in the UK) and is publicly traded. topmoneycompare.co.uk+1

Conclusion: Why Remitly Remains a Top Choice in 2026

Remitly’s evolution from a small Seattle startup to a global remittance powerhouse is a testament to how much people value speed, trust, and simplicity.

For UK users sending money to Nigeria in 2026, it’s one of the fastest, most transparent, and easiest-to-use services on the market.

Whether you’re sending ₦10,000 or ₦1,000,000, the app’s interface makes every transaction smooth and secure — and that’s exactly why millions of users continue to rely on it year after year.

🌍 In short:

Remitly = Fast + Safe + Simple + Transparent.

So next time you need to send money home, you’ll know your loved ones in Nigeria will receive it quickly, securely, and stress-free.

Add a Comment